Overview

RULEMATCH is accelerating digital asset trading with an interbank trading venue for the spot trading of cryptocurrencies and digital assets.

RULEMATCH is accelerating digital asset trading with an interbank trading venue for the spot trading of cryptocurrencies and digital assets.

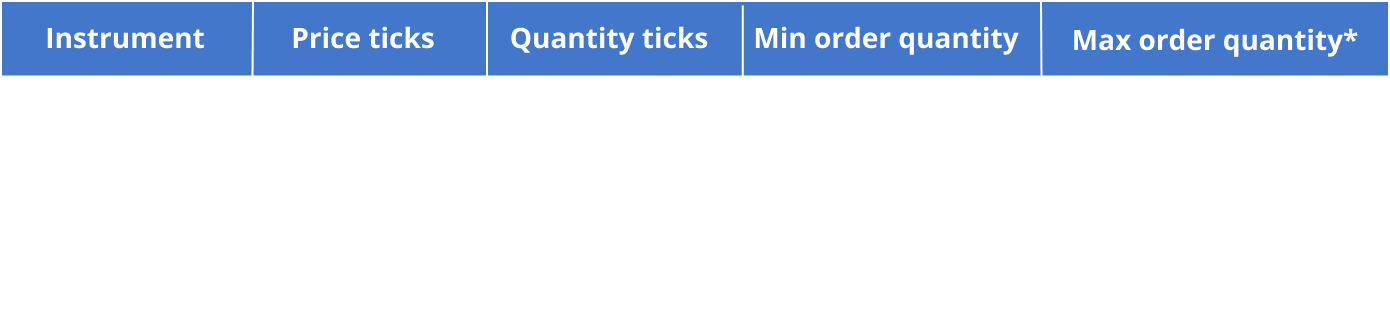

In a first phase, the RULEMATCH trading venue offers a spot market for the following trading pairs:

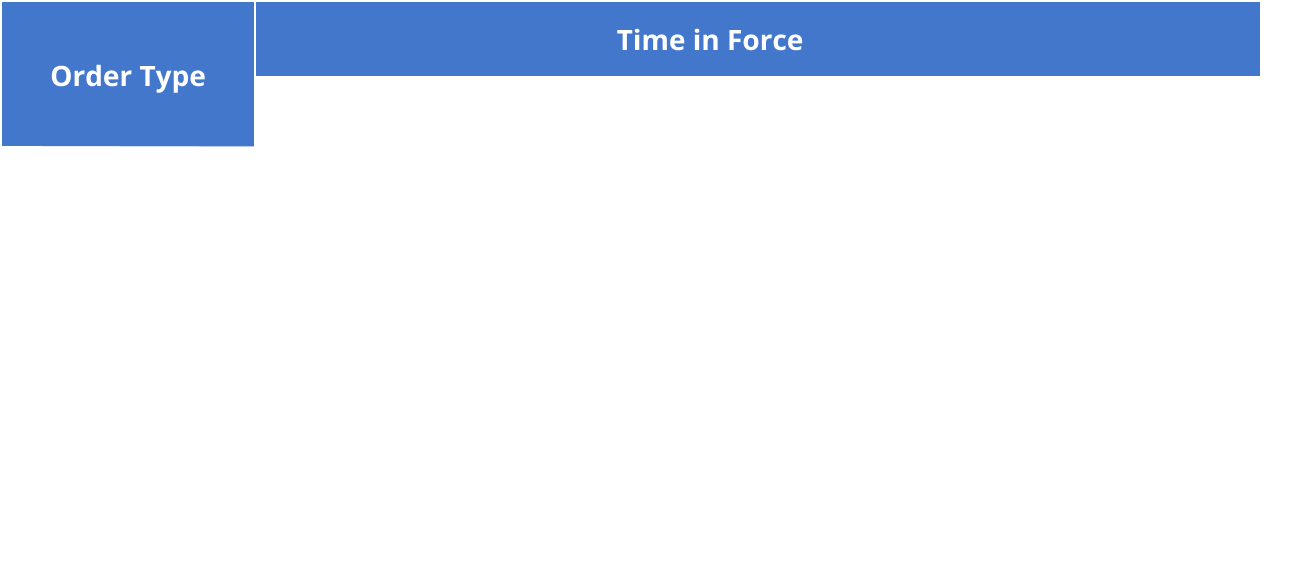

The following orders may be placed:

The following time-in-force conditions may be used:

The venue operates 23.5 hours per day, seven days per week, with a daily operational pause between 21:30 UTC and 22:00 UTC. Trading is divided into the following trading sessions:

For more information, refer to the Order types and Trading sessions sections.

Participation on RULEMATCH is open to supervised financial institutions – banks and securities firms – only.

Other financial institutions may gain access to the trading venue through a participant that offers Direct Market Access or Sponsored Access.

Participants onboard with support from RULEMATCH participant services and connect to trade on the venue via one of the technical connection options available (see Connectivity) or via the RULEMATCH trading interface.

Participants on RULEMATCH may consume market data and trade on the venue using the following access protocols:

Participants may connect to the venue via Public Internet or VPN Tunnel, connect directly via AWS Private Link or Equinix POP service, or collocate within the Green Data Centers. A comprehensive trading interface and treasury dashboard also make it possible to place and monitor trading activity.

RULEMATCH uses a variety of industry-leading technical and service providers to serve Participants – including Nasdaq, Metaco, Elliptic, Green Data Centers and others.

Trading engine and market surveillance technology are provided by Nasdaq with its world-class multi-matching engine and integrated market surveillance technology.

Flow Traders serves as a designated market maker to ensure consistent and competitive liquidity on the RULEMATCH trading venue.

RULEMATCH and SIX have a strategic partnership with an end-to-end solution combining the trading and settlement capabilities of RULEMATCH with the off-exchange crypto custody services of SIX.

tradias serves as a designated market maker on the RULEMATCH trading venue.

Crypto assets on the trading venue are handled using the Ripple Custody system, which leverages IBM FIPS 140-2 Level 4 certified HSM hardware hosted on-premises for key creation and protection.

The RULEMATCH trading venue is integrated into Wyden, a leading Swiss-based OEM system, giving Wyden’s clients easy access to the liquidity of RULEMATCH.

Talos, a leading global trade and order management solution, is integrated with the RULEMATCH trading venue, giving Talos clients access to the guaranteed liquidity on RULEMATCH.

The RULEMATCH trading engine is housed redundantly in highly-secure, banking-grade locations from Green Data Centers in the Zürich metro area.

Kaiko provides reference data for the RULEMATCH trading venue.

RULEMATCH uses the Elliptic platform to support blockchain address screening, transaction forensics and AML compliance in handling crypto assets.

For KYC and AML compliance and participant data handling, RULEMATCH uses Pythagoras with its screening, monitoring and client management modules.

Custom technology integrations and software development are provided by Ergon, a leading Swiss software development provider based in Zürich.

RULEMATCH is a member of the Digital Token Identifier Foundation, the registration authority for the ISO 24165 standard, which is responsible for issuing and maintaining DTIs.

Selected RULEMATCH participants serve as providers of sponsored access to the RULEMATCH venue, allowing their institutional clients to trade directly on RULEMATCH, while the sponsoring participant handles clearing and settlement.

Swiss-based securities firm ISP Securities offers sponsored access to RULEMATCH. More information available here.

Based in London, GCEX offers prime brokerage access to the RULEMATCH venue. More information available here.

Leading Liechtenstein-based crypto service provider Bank Frick offers sponsored access to the RULEMATCH trading venue. More information available here.

DLT Finance offers access to RULEMATCH for its institutional clients through its multi-venue aggregator. More information available here.

Participation on the RULEMATCH trading venue is open to supervised financial institution from Switzerland and equivalently regulated countries, subject to the international scope of RULEMATCH.

Participants may trade for their own account (House) or for the account of their clients (Segregation). With the approval of RULEMATCH, qualifying participants may also offer Direct Market Access or Sponsored Access services to their clients, such as hedge funds, family offices and external asset managers. Responsibility for clearing always remains with the sponsoring participant.

The RULEMATCH trading venue is open to financial institutions only. Participants must be licensed banks or securities firms in jurisdictions subject to the international scope of RULEMATCH.

Participation on the RULEMATCH trading venue is open to supervised financial institution from Switzerland and equivalently regulated countries.

RULEMATCH AG does not offer its services to US Persons, as defined by Regulation S, which includes agencies or branches of a foreign entity that are located in the US and US partnerships or corporations organized or incorporated under the laws of the US (other than agencies or branches of such entities located outside of the US that are operated for valid business reasons, engaged in banking or insurance and subject to substantive banking or insurance regulation in the jurisdiction where located).

RULEMATCH provides non-participants with the ability to use the trading platform via Direct Market Access (DMA) or Sponsored Access (SA). Banks and securities firms can extend this opportunity to their non-participant clients, enabling them to trade on RULEMATCH via their existing banking system connection (Direct Market Access) or their own technical connection (Sponsored Access). In both scenarios, sponsoring participants maintain complete visibility into their clients’ trades and positions. Responsibility for clearing always remains with the sponsoring participant.

Direct Market Access (DMA) enables participants’ clients to access the RULEMATCH trading venue through their intermediary bank or security firm. With DMA, traders have more control over the trading process as they can send orders to the venue and receive real-time executions via the existing infrastructure of their sponsoring participant.

This option is particularly popular among professional trading clients who use their own order management systems (OMS) or execution management systems (EMS) to execute large volumes of orders in a quick and efficient manner.

DMA clients typically use the same FIX gateway as the participant, and all trading activities are recorded in a segregated account within the participant’s account structure. For smaller trading firms with limited resources, DMA can be a cost-effective solution to establish a connection to the RULEMATCH trading venue.

The Sponsored Access (SA) service provides market participants’ clients with a direct technical connection to the RULEMATCH trading venue through their own gateway, such as FIX or OUCH, enabling them to transmit orders electronically and directly without routing them through the participant’s internal electronic trading systems.

This setup is ideal for high frequency traders and hedge funds executing low latency strategies. SA traders have control over the trading process, including the ability to send orders and receive real-time market data. However, the Sponsoring participant is ultimately responsible for ensuring compliance with regulatory requirements and risk management protocols.

RULEMATCH offers a range of Pre- and At-Trade Risk Management Controls to allow Sponsoring participants to effectively manage the order flow of their SA clients. The associated risk management parameters can be maintained through a graphical user interface. Sponsoring participants can further manage risk by activating a “Kill-Switch”, which cancels all outstanding orders of the sponsored clients and prevents new order entries.

The RULEMATCH trading venue is powered by the matching engine technology of Nasdaq. The multi-matching engine enables swift, precise order matching to meet the rigorous demands of institutional traders of cryptocurrencies and digital assets.

Each instrument on RULEMATCH is traded on a Central-Limit Order Book (CLOB) that collects and matches orders according to the price-time priority principle. Incoming orders are compared to the passive orders resting in the CLOB and trades occur according to the rules of the matching engine.

The matching engine is capable of achieving sub-80 microsecond execution latency via FIX, while collocated participants using the OUCH protocol can achieve execution speeds below 25 microseconds.

The matching engine reference price corresponds to whichever of the following reference price sources is most recently set during the current trading day:

Trades concluded bilaterally and off-order book between two onboarded participants of the RULEMATCH trading venue can be reported, to go through the clearing and settlement process of RULEMATCH.

A participant may enter a one-sided trade report for this purpose, which should either be accepted by the other counterparty or matched by another trade report initiated by them. Once accepted or matched, reported trades are subject to approval by the RULEMATCH Market Operations team, after which they are disseminated as trades within the venue.

The RULEMATCH trading venue is built to offer a focused market for financial institutions.

The following trading pairs are currently offered:

*The Max Order Quantity is also restricted by each account’s available margin. In case an order would lead to a margin limit breach, it would be rejected by pre-trade risk controls even if the quantity is below the values specified in the above table.

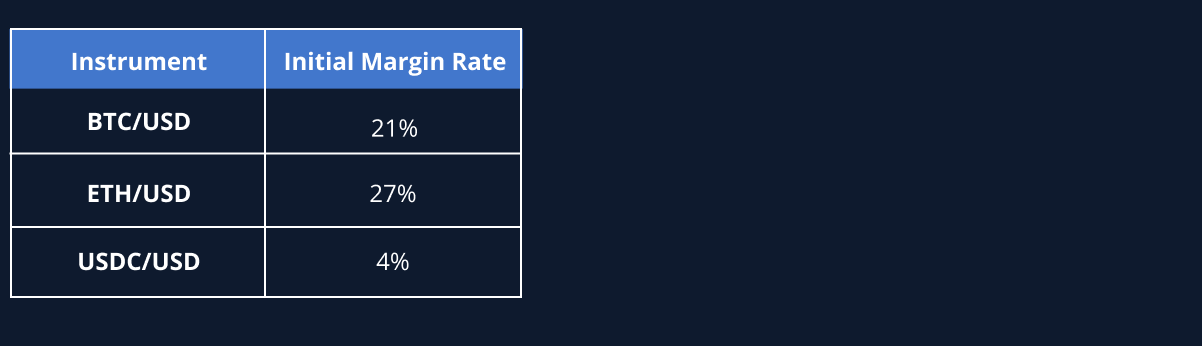

In keeping with the continuous nature of cryptocurrency and digital asset trading, the RULEMATCH trading venue operates seven days per week, 365 days per year over a trading day of 23.5 hours.

The trading day at RULEMATCH lasts from 22:00 to 21:30 (+1) UTC and is divided into three separate trading sessions:

Each trading session is dictated by specific rules with respect to order entry, which are highlighted in the Order Types section.

A trading day is followed by the close of trading that lasts from 21:30 to 22:00 UTC. During the close of trading no orders/quotes can be placed.

Trading days from Monday to Thursday are each represented by one trading cycle. From Friday to Sunday, the trading days are grouped into one, single trading cycle (“extended trading cycle”).

Trading session sequence of RULEMATCH

Continuous trading allows orders and quotes to be immediately matched according to the rulebook of RULEMATCH.

Incoming orders are, from a trading perspective, always considered as aggressive and compared to the passive orders in the book for potential matching.

Opening and closing auctions consist of an interest collection phase, followed by an uncross, which is used to execute possible matches. During the interest collection phase, orders and quotes are accepted and allowed to cross without any matching. The uncross is performed in the transition to the next session, with the equilibrium price of the auction used as the matching price. All orders are considered passive during an auction, irrespective of their attributes.

The equilibrium price is calculated and disseminated by the matching engine throughout the duration of the auction, assuming there are crossed orders in the central limit order book.

The prices used in the selection of equilibrium price are all valid price ticks between and including the highest and lowest limit orders crossing and locking the market, extended with one tick up from the highest and one tick down from the lower limit price. With these eligible prices, the equilibrium price is calculated using Nasdaq’s proprietary algorithm that seeks to maximize the executable quantity while minimizing any potential surplus.

Participants trading on RULEMATCH may use a variety of order types depending on their needs and trading strategies. Combined with a variety of time-in-force and triggering conditions, RULEMATCH offers flexible options for institutional traders of cryptocurrencies and digital assets, enabling them to deploy the right order for the right situation.

A limit order must specify a valid price and will only execute in part or in full at prices equal to or more generous than its specified limit price.

A market order is an unpriced order that will execute against the best-priced orders in the order book. Market orders cannot be stored in the order book during continuous trading and will be canceled if they are not immediately executed.

A best limit order will automatically be assigned to the best price on the same side of the order book at the time the order is registered. No price is therefore required. The order is rejected if no order is available on the same side of the order book. Once in the order book, the order price is never amended even if a better-priced order is entered.

A market-to-limit order will execute at the best possible price on the opposite side of the order book. If the order is partially matched, the remainder is converted to a limit order priced at match price. In comparison with a normal market order, the Market-to-Limit order only executes at the best price level and therefore does not trade through the order book. Once in the order book, the order price is never amended even if a better-priced order is entered.

An iceberg order consists of a visible and a total quantity. The visible quantity of the iceberg order is published in the order book. If the visible quantity of the iceberg order is executed, another tranche of the total quantity is entered as visible quantity in the order book until the order is fully executed, canceled, or expired. Each tranche shall be given a new time stamp and identification number and will lose time priority. An iceberg order can be entered as a limit, best limit or market-to-limit order, by defining both the visible and the total quantity of the order.

An Imbalance order can only participate in an Opening/Closing Auction at the equilibrium price and any unfilled balance after the uncrossing will be canceled. Imbalance orders do not affect the equilibrium price and are executed only against any surplus imbalance (i.e. behind limit and market orders) and not against each other. Imbalance orders are not publicly shown, neither as order depth or price depth.

Time in Force conditions determine how long an order will be kept in the market if it has not yet been executed.

Orders with IOC time in force shall be executed immediately, partially or in full. Non-executed parts of the order shall be deleted without entry in the order book.

Orders with FOK time in force shall be executed immediately and in full or not at all. If an immediate, full execution is not possible, the order shall be deleted without entry in the order book.

Day orders are valid during the current trading day only. If the order cannot be executed in this timeframe, it is automatically canceled following the closing auction of the trading session.

GTC orders remain in effect until executed or canceled. All GTC orders are automatically canceled 180 calendar days after entry.

GTD orders remain valid until the close of trading on a specified trading day. GTD orders turn into Day orders at the final date of their validity. The maximum term of validity shall be 180 calendar days.

GTS orders are valid until the end of a defined session and are only kept in the order book for the trading day on which they were entered.

Allowed time in force conditions per order type:

Iceberg orders inherit the allowed Time in Force conditions of the order type they were entered as (Limit, Best Limit or Market-to-Limit order).

Triggering conditions are optional and represent the mechanism used by the matching engine to automatically activate orders based on specified criteria.

The following triggering conditions are available:

Only one triggering condition per order is allowed.

Un-triggered orders with time in force up to and including Day will expire at the logical day shift, either on a session change (if applicable), or following the closing auction. Un-triggered orders with time in force longer than Day will be reloaded in the next trading day. As a result, an un-triggered order with time in force FOK, IOC, Day or GTS will therefore not be reloaded in the next trading day, while GTC and GTD will always be reloaded the next trading day.

At Open and At Close orders can be entered with the triggering session set to Opening (Closing) Auction and the time in force set to GTS for the same trading session.

Stop loss orders can be entered as a market order with an IOC time in force and trigger on price but will only be valid for the current trading day. In case longer validity is required, a Stop limit order can be used, set up as a limit order with a GTD time in force and trigger on price.

The following features are not allowed during opening and closing auctions:

IOC time in force is allowed during the opening and closing auctions, with any remaining quantity canceled after the uncrossing.

Imbalance orders may only be entered during the opening and closing auctions and always as active orders (no triggering conditions). All time in force values, except FOK, are allowed but lead to the same outcome of any remaining quantity of the Imbalance order being canceled after the uncrossing.

Quotes represent a special type of transaction that includes both a buy and sell side with corresponding prices and quantities. They are meant to provide high frequency and low latency order entry for market makers and liquidity providers. A new quote always replaces a previous one, per order book and user.

Thus, a user is only allowed to have one quote per order book. Bid and ask prices in an incoming quote are not allowed to cross or lock with each other. Quotes are implicitly limit orders with time in force set to Day.

RULEMATCH has established pre-trade controls that ensure the fair, efficient and orderly operation of the trading venue. In addition, pre-defined trading interruptions are programmed to safeguard participants from potentially dislocated prices that may arise in the case of extraordinary situations.

The matching engine of the RULEMATCH trading venue rejects incoming orders and quotes in the following cases:

All information related to price/quantity ticks and max/min order volumes are highlighted in the Tradeable Instruments section.

The price of incoming orders is validated against price limits set on an instrument basis. The price limits are dynamically calculated based on the matching engine reference price. If the price of an order is below the lower price limit (LPL) or above the upper price limit (UPL), it is rejected by the matching engine.

The price limits are calculated as follows:

Upper price limits are rounded down to closest valid price tick, whereas lower price limits are rounded up to closest valid price tick.

The price limit for a trigger order is only validated at the triggering event and not at entry.

UPL & LPL Factors are currently set at 50% for all tradeable instruments.

The purpose of the circuit breaker is to protect participants from erroneously priced trades resulting from extreme market volatility or potential service disruption. The circuit breaker triggers during continuous trading when the execution price deviates more than a certain percentage threshold (CB Limit) from the external reference price or the last match price, depending on which of the two has the latest timestamp. The CB Limit is configured on an instrument basis, currently set to 3% for all tradeable instruments.

The aggressive order that triggers a circuit breaker will be partially executed up to the 3% point of trigger, and any remaining quantity will be canceled with the activation of the circuit breaker.

Once triggered, the circuit breaker sets a predefined trading session sequence that overrides the normal trading schedule.

RULEMATCH circuit breaker schedule:

If deemed necessary in order to sustain fair and orderly trading, RULEMATCH Market Operations may utilize the kill switch on certain participants, essentially blocking them from further order entry and canceling all their live orders.

This functionality may also be utilized by sponsoring participants, in case they need to block their DMA or Sponsored Access clients from further trading as a risk management measure.

Participants trade on the venue using collateral pledged to cover the open market, as well as clearing and settlement risk. RULEMATCH allows for multi-collateral portfolios valued in USD – which is also the currency used for margining purposes.

Margin on RULEMATCH is comprised of an Initial Margin (IM) component (reflecting the potential market risk), and a Variation Margin (VM) component (reflecting the current Mark-to-Market valuation).

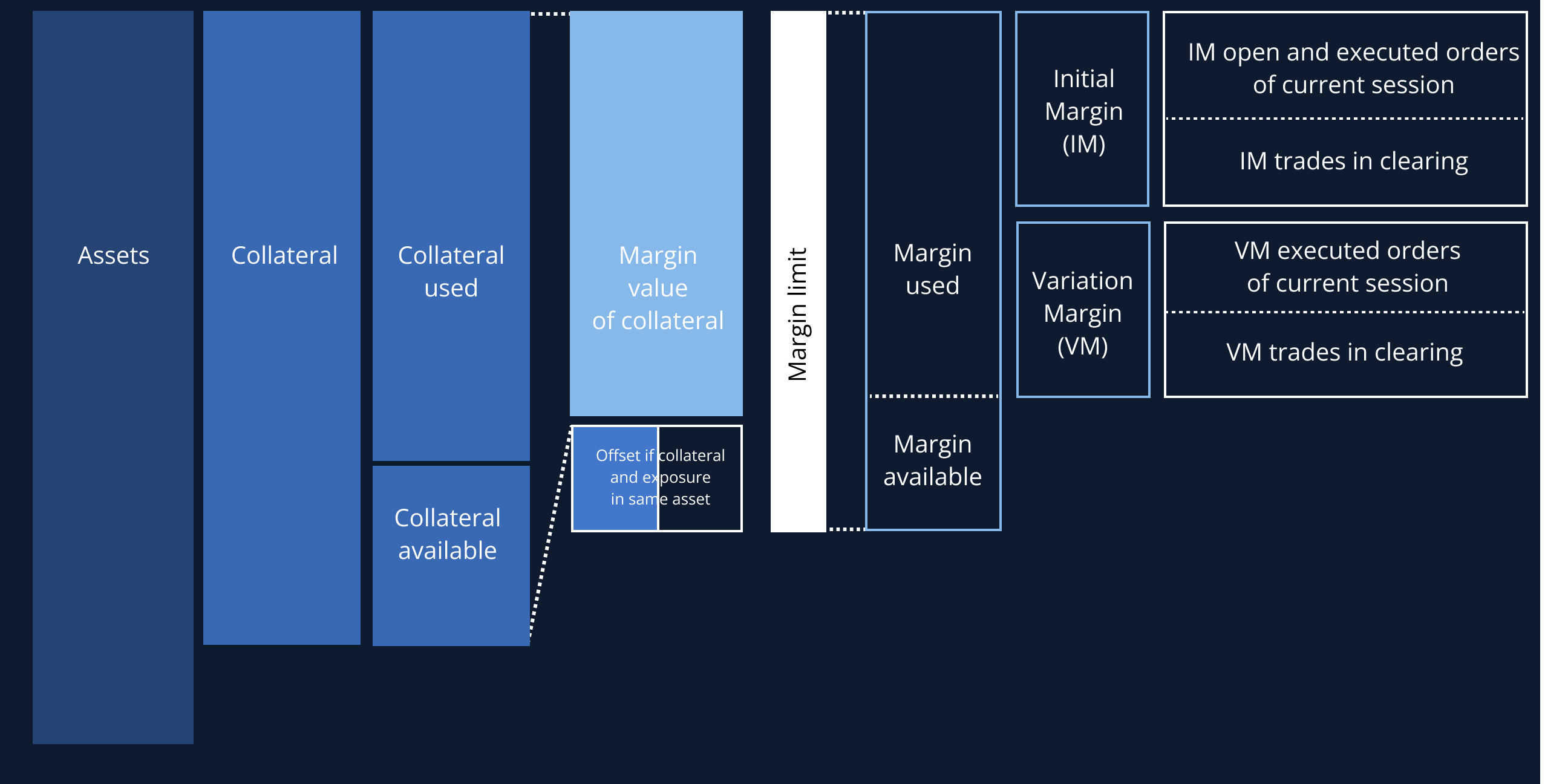

The collateral and margining landscape of RULEMATCH is depicted below. This graph is further used as a reference in the individual descriptions of each component.

The collateral and margining landscape for RULEMATCH participants.

Assets: The USD-denominated value of all assets being held in the account.

Collateral: The USD-denominated value of all assets assigned as collateral in the account. Only assets that are not submitted as obligations of a clearing cycle or are not currently quarantined are free to be used as collateral.

Collateral used/available: The ratio of collateral used over the full collateral is always equal to the ratio of margin used over the margin limit. Hence, if an account is currently utilizing 60% of the margin limit, collateral used will also be equal to 60% of the collateral. Collateral available is equal to the remaining amount (e.g. 40%), and serves as a rough indication of the unutilized liquidity that could be withdrawn from the reserved collateral, without causing a breach of the margin limit.

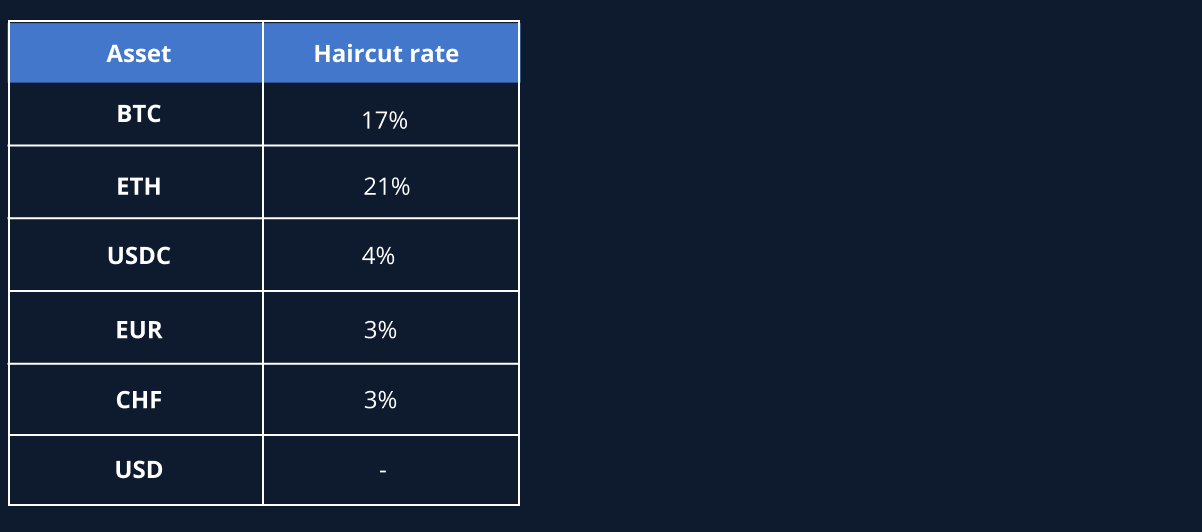

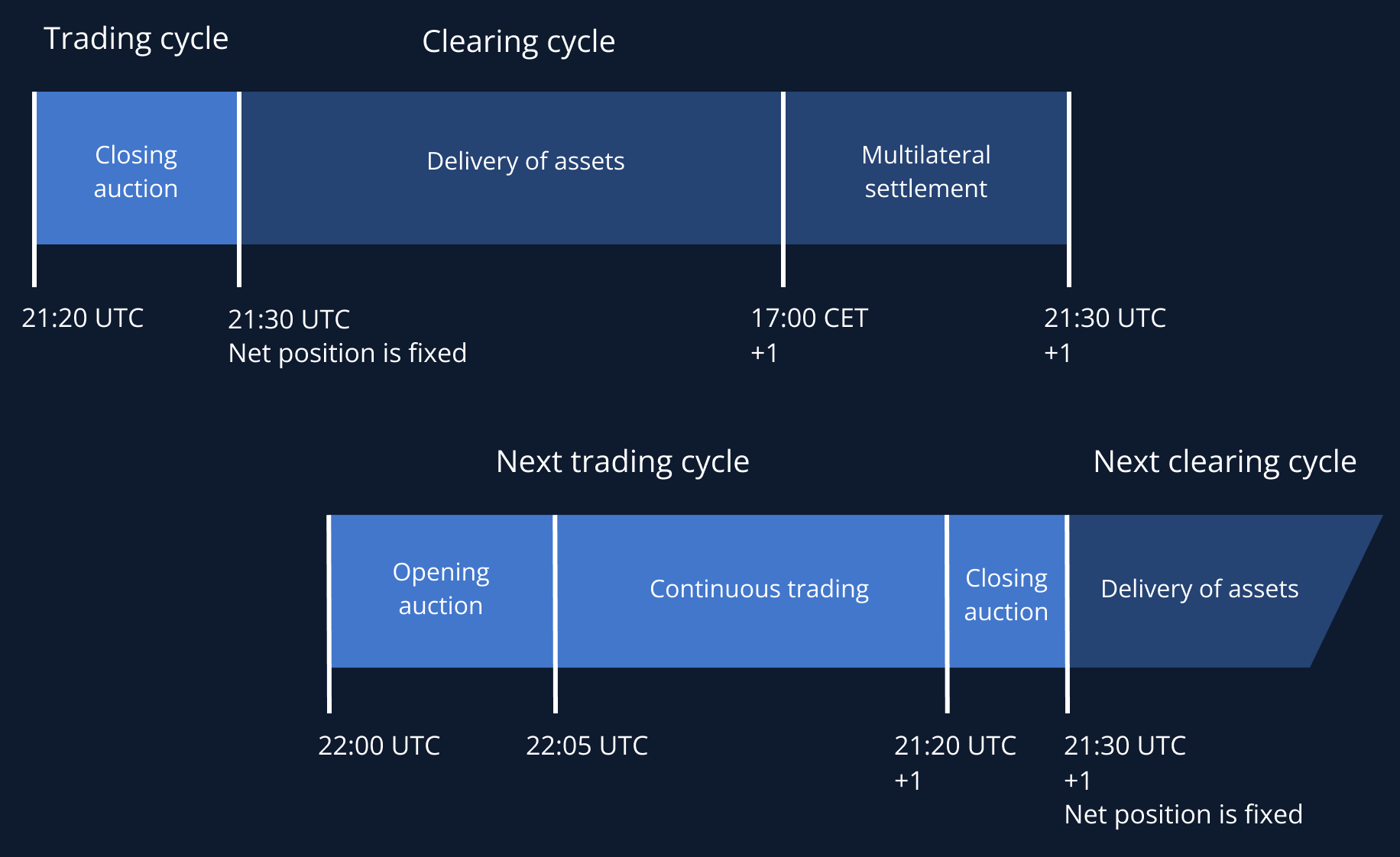

Margin value of collateral: The USD-denominated value of the collateral, after the haircut rates have been applied per asset. The table below indicates the current haircut rates for each tradeable asset.

Matched collateral benefit: In the case of both collateral and trading/clearing exposure being on the same asset, the volatility of that asset no longer contributes to additional risk. As a result, the haircut rate is reversed, up to the amount of the exposure itself, and not the full amount of the collateral.

Margin limit: The sum of “Margin value of collateral” and “Offset if collateral and exposure in same asset”. This amount ultimately defines the maximum amount of trading and clearing exposure the participant’s account can undertake.

RULEMATCH allows all tradeable currencies of the venue to be used as collateral, plus EUR and CHF. The collateral portfolio is valued in USD terms, considering the volatility of collateral assets by applying an individual haircut on each asset’s USD valuation.

The valuation of the collateral ultimately leads to the margin limit, which defines the maximum amount of trading and clearing exposure the Participant’s account can undertake.

Initial margin: IM represents the open market risk of the orders and trades placed on the participant’s account. It is calculated for both open and executed orders of the current trading session, as well as trades executed on the previous session that are now open for clearing and settlement. The sum of the two leads to the full initial margin.

The IM for open and executed orders of the current trading session is based on the open exposure per instrument, which is calculated as follows.

Open exposure per instrument = Max (Total Net Buy, Total Net Sell), where:

Total Net Buy = Traded Bought – Traded Sold + Open Buy Orders

Total Net Sell = Traded Sold – Traded Bought + Open Sell Orders

By choosing the maximum of the two metrics, the open exposure indicates the net position of the account with the highest market risk for each instrument, which is then converted into USD and multiplied by the IM rate of the instrument. The value for each instrument is then summed.

Trades of the previous session, currently open for clearing and settlement are also netted for each individual instrument, and the net open position is valued in USD and multiplied by the IM rate of the instrument.

The table below indicates the current IM rates per instrument.

Variation margin: VM represents the current profit and loss position stemming from the trading activities on the participant’s account. It is calculated for both the current as well as the previous session’s trading activities that are currently open for clearing. The sum of the two (for all applicable instruments) leads to the full variation margin.

Margin used: The full margin used is calculated as the sum of IM and VM. It is important to note that IM is always increasing the margin used for the account, while VM could either decrease or increase it, depending on whether the account is at a mark-to-market profit or loss.

Margin available: The difference between the margin limit and margin used leads to the margin available on the account. This metric is split between the tradeable instruments of the venue, based on a percentage allocation defined by the participant on each account (e.g. 60% BTC/USD – 40% ETH/USD). The participant has the ability to configure this allocation at any point through the UI of RULEMATCH. Once the available margin for an instrument has been breached, the account is no longer able to enter orders on this instrument. The participant would have to either bring more collateral to the account, allocate more available margin on the instrument, or reduce the exposure by e.g. removing open orders or executing a risk-reducing trade, to re-enable order entry. It is important to note that maximum order size is also limited by the available margin, in order to restrict participants from entering an order that would lead to a breach of the margin limit.

The full margin utilized by an account is always the sum of Initial Margin (IM) and Variation Margin (VM). Both components are USD-denominated.

Participants settle on a post-trade basis through the T+1 clearing and settlement cycle of RULEMATCH. The system performs a multi-lateral netting of all trades under the same trading cycle, leading to greater capital efficiency for participants.

Post-trade settlement is strictly based on the principle of Delivery vs Payment (DVP), which substantially reduces the uncertainty linked to settlement and counterparty risk.

RULEMATCH never acts as a counterparty within the entire clearing and settlement process. All transfers initiated at the end of each cycle occur between individual blockchain addresses and fiat accounts, therefore never leading to pooling of funds or exposure to the balance sheet of RULEMATCH.

Trades executed off-order book may also be reported and settled through RULEMATCH, given that both parties are participants in the platform, in order to benefit from multilateral netting with the rest of the on-order book trading flow, as well as a single settlement transaction per cycle.

The completion of the closing auction (21:30 UTC) signals the end of the current RULEMATCH trading day, at which point the corresponding clearing cycle begins. RULEMATCH discloses each participant’s bilateral entitlements and obligations. In addition, each participant is calculated the sum of all bilateral entitlements (positive sign) and obligations (negative sign), in order to reflect a multilateral net position per asset. The negative net positions per asset (clearing obligations) reflect the assets to be submitted by the participant.

All participants undertake to reserve their clearing obligations at the latest by the Clearing Deadline (17:00 CET of the next day). Once all clearing obligations are fulfilled, settlement is facilitated by RULEMATCH using an algorithm that minimizes the number of settlement transactions between participants. Participants whose transfers are delayed must provide sufficient evidence to RULEMATCH that the transfers have been initiated. Only in this case, the Clearing Deadline may be extended up to 09:00 CET of the following day to allow for the delayed obligations to come in, at which point the settlement transfers are executed. Participants that cause delays in the settlement process are subject to penalty fees.

If a participant fails to reserve the assets of its clearing obligations by the Clearing Deadline or does not provide evidence of an executed transfer, it is deemed to have defaulted. At this point a ‘Step-In Participant’ may take over the clearing obligations of the defaulted participant in order to guarantee the multilateral settlement. Step-in participants are remunerated from the collateral of the defaulted participant. In the infrequent case of no available Step-In Participant, settlement ultimately falls back into bilateral mode, RULEMATCH facilitates a P&L (cash) settlement of the bilateral net positions among the participants, by valuing them in USD terms, and utilizing their reserved collateral to cover the resulting P&L settlements. Penalty fees for delayed or defaulting participants, as well as remuneration of their affected counterparties is governed by the rulebook of RULEMATCH.

RULEMATCH offers its participants flexible account structuring to meet their needs as financial institutions. The Participant occupies the top position of the hierarchical structure.

Underneath the Participant there may be multiple Organizations, the main one being the Participant Organization. Additional Organizations may belong to Direct Market Access or Sponsored Access clients, who are granted access to RULEMATCH through the Participant.

Each Organization has different Accounts which are described below. Finally, every user is assigned to one or multiple Accounts with specific roles. More information on user roles can be found in the User Roles section.

RULEMATCH offers the following account types to its participants:

House accounts are for the purpose of proprietary trading or if the Participant trades for its clients as a principal. For the house Account, the Participant is obliged to designate itself as beneficial owner of the assets.

Segregation accounts may be opened by the participant for specific clients and for segregation purposes. The segregation account is used for agency trading and the allocated assets must belong to that specific client.

Authorised users can be granted access to the RULEMATCH system at account level.

RULEMATCH offers a variety of roles for the users of the trading venue, with the purpose of flexibly serving the needs of individuals from different departments of a financial institution. User roles can be assigned on the Participant level of the hierarchy (more details on hierarchy under the Account structure section), as well as on the Organization and Account levels.

User roles in the organization & account levels include the same permissions. However, the organization level has an ‘umbrella’ scope purely for convenience purposes, allowing permissions to be encompassed by all accounts under this organization.

Roles on the following table can only be assigned to users who are part of the participant organization. The relevant description of each user role always refers to all the organizations and accounts under the participant.

RULEMATCH makes it possible for financial institutions to connect to the trading venue swiftly and securely. The industry-standard FIX access protocol (4.4 and 5.0SP2) is available. Participants and sponsored non-participants also have the option to use Nasdaq’s proprietary ITCH/OUCH and MDF protocols.

RULEMATCH offers a variety of connectivity options in order for Participants to choose the one that matches their technical infrastructure and latency expectations. These options are grouped into four main categories:

Internet:

Connectivity via Internet allows the participant to connect from anywhere in the world, with no onsite or AWS presence required. Only registered IP addresses of participants are allowed to access via Internet, and RULEMATCH uses an allowlist to allow connections. No plaintext traffic is supported.

The following network security protocols are available:

AWS Private Link:

RULEMATCH provides the possibility to connect participants via AWS Virtual Private Clouds (VPCs). This enables private connectivity between VPCs and the participants’ on-premises networks without exposing the traffic to the public Internet.

Participants hosting their trading services in AWS Cloud can benefit from a low-latency communication with RULEMATCH services using AWS Direct Connect to provide a stable and ultra-fast path to the participants’ exposed services. The following AWS Cloud regions are supported:

Connectivity via AWS private link requires the participants to have an AWS presence in a RULEMATCH supported region.

No encryption is necessary, but TLS endpoints are available.

Direct Connect:

Equinix PoP Service

Through the Point of Presence (PoP) service, RULEMATCH provides high-speed fiber network connections. RULEMATCH PoP gives participants the ability to simply cross-connect from an Equinix datacenter to the RULEMATCH network and receive low-latency market data access and order entry capabilities.

Connectivity via direct connect requires the participant to be able to configure a physical cross-connect in a RULEMATCH supported datacenter:

In addition to the RULEMATCH PoPs, connections are also possible via Internet Exchanges (iX). SwissIX is the currently supported Internet exchange.

No encryption is necessary (except for iX connection), but TLS endpoints are available. Wireguard & IPSec VPNs are available on request. Routes are propagated using BGP, both in PoPs as well as in iXs.

Green Cross Connect & DCI

The RULEMATCH matching engine runs in a redundant setup in two Green datacenters. Participants also having their trading infrastructure within the Green datacenters may use the Green Cross Connect or Datacenter Interconnect (DCI) services, in order to setup a direct connection to the RULEMATCH matching engine. RULEMATCH is present in two locations:

No encryption is necessary, but TLS endpoints are available. Wireguard & IPSec VPNs are available on request. Routes are propagated using BGP. Single Direct Connect lines are subject to unexpected hardware failure or planned maintenance. RULEMATCH recommends that participants set up two separate Direct Connects to ensure continuous coverage.

Colocation:

Participants are able to colocate in the Green Data Centers, achieving the shortest path possible to the RULEMATCH matching engine. Colocated participants benefit from non-encrypted (“plaintext”) communication to RULEMATCH services, which in combination with the binary communication protocols from Nasdaq (OUCH/ITCH) leads to the lowest latency possible for order entry and market data services.

Connectivity method summary:

FIX (Financial Information eXchange) is a widely used messaging protocol in the financial industry for the electronic exchange of trade-related information. FIX allows participants of RULEMATCH to transmit orders, trade executions, and receive detailed order book information in a standardized format.

FIX 4.4 is one of the most widely implemented versions of the FIX protocol and has become a de facto standard for many financial institutions.

FIX 5.0 is a newer, enhanced version of the FIX protocol. It introduces new message types, expanded field sets, and improved support for complex trading instruments and regulatory requirements.

All FIX specifications for Order Entry, Drop Copy, Market Data and Reference Data, as well as QuickFix dictionary are available within the participant section of RULEMATCH.

ITCH and OUCH are communication protocols developed by Nasdaq for the purpose of facilitating ultra-low latency trading. These protocols are of particular relevance for participants collocated with the RULEMATCH matching engine.

ITCH (Nasdaq TotalView-ITCH):

ITCH is a proprietary data protocol used by Nasdaq to disseminate real-time, detailed order book information. It provides a comprehensive view of the limit order book for all instruments traded on RULEMATCH, including the best bid and ask prices, order sizes, and other market data. ITCH is primarily used by high-frequency traders, market makers, algorithmic trading systems, and other market participants who require low-latency access to real-time order book data.

OUCH (Omnibus/Unicast/CHannel):

OUCH is another proprietary protocol developed by Nasdaq. It is used for submitting orders, receiving order confirmations, and retrieving other trading-related information from the trading venue. OUCH is a binary protocol that offers a faster and more efficient way of sending and receiving trading instructions compared to older text-based protocols.

MDF (Market Data Feed)

Nasdaq MDF is an ITCH-like direct data feed that distributes complementary market data not contained in the regular ITCH feed, like the Market-by-Price (MBP) depth, time messages, and market announcements.

Participants and sponsored non-participants who trade on the venue may colocate their systems with the RULEMATCH matching engine in the Green Data Centers. Cross-connection is also available at Equinix ZH4. Both are located in the Zurich metro area.

With colocation, traders can take advantage of the ultra-low latency and proximity to the RULEMATCH matching engine built with Nasdaq technology, to deploy sophisticated high-frequency strategies.

This colocation service is offered with the ITCH and OUCH communication protocols developed by Nasdaq, which enable sub-30 microseconds execution latency.

Both ITCH and OUCH are designed to handle high-volume and low-latency trading activities, catering to the needs of institutional investors, broker-dealers, and other market participants who require rapid access to market data and execution capabilities.

These protocols make it possible to facilitate efficient and reliable communication between traders and the trading venue of RULEMATCH.

RULEMATCH operates with a transparent fee model for participants trading on the venue, based on the schedules outlined below. Fees are charged monthly on the USD asset account. The accumulated fees for the previous month are always charged on the first business day of the month. A detailed overview of the fees can be found in the billing report of the respective Account.

RULEMATCH offers a reduced fee tier to Accounts that provide additional liquidity to the Order Books, given the Account meets specified fee schedule conditions. This reduced fee tier applies only to the Instruments for which the following conditions are met:

Trading fees (trading volume independent):

Maker/Taker: 0.005% / 0.015%

Clearing & settlement fees (trading volume independent):

Maker/Taker: 0.003% / 0.003%

All remaining fees are unaffected and apply according to the previous section.

Participants may opt into the Liquidity provision fee tier with one or more of their Accounts for specific instruments at the beginning of each month. For each month during which the obligations are met, the Account will benefit from this fee schedule. In the event the obligations are not met, the standard fee schedule will apply.

Fees for trading on RULEMATCH are tiered according to the trading volume of each Organization and based on a Maker/Taker model.

Withdrawal fees are also charged on the USD asset account according to the following schedule.

Digital asset withdrawal USD 8.00

FIAT withdrawal USD 38.00

Fiat withdrawals can be processed with same-day value date if initiated before the cut-off time:

For USD and EUR, transactions may be processed with same value date if initiated before 14:00 CET, but this cannot be guaranteed.

Market data can be retrieved free of charge via the FIX & NMDF protocols. Market data via ITCH is subject to a fee of USD 1’000 per month.

Fees linked to trading via colocation can be provided on request.

No additional admission or annual pro rata fees apply.

Serving financial institutions means adhering to the stringent Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations of Switzerland. As a Swiss-based trading venue, RULEMATCH follows all legal requirements set out in the Swiss Anti-Money Laundering Act (AMLA) and Anti-Money Laundering Ordinance (AMLO-FINMA).

With the help of industry-leading tools for participant management, name, sanctions and transaction/wallet screening, RULEMATCH maintains a strict AML framework to ensure the integrity and security of the market for trading venue participants.

RULEMATCH prepares a comprehensive KYC for each of its participants which is consistently updated. When onboarding a new participant, RULEMATCH uses Fidentity, a Swiss-based technology solution, to identify and verify select individuals. Participants that trade on the RULEMATCH venue can be assured that their counterparties have been fully vetted before admission.

Only regulated financial institutions and select companies that are supervised by a regulated financial institution are eligible for admission to trade on the RULEMATCH trading venue.

In addition, RULEMATCH only admits participants who conduct business in one of a limited number of well-regulated countries and which do not pose an increased risk of money laundering. These restrictions are designed to provide financial institutions with a trading venue that meets their institutional standards.

Utilizing Elliptic, an industry-leading blockchain monitoring tool and an automated sanction and name screening system, RULEMATCH identifies and resolves AML and sanction risks dynamically to ensure the integrity of the market.

The handling of assets being traded, settled, and used as collateral is treated with the utmost care. RULEMATCH utilizes the banking-grade Ripple Custody solution to ensure strict asset segregation on individual blockchain addresses and secure key management for all asset transfers. FIAT for trading is handled by a AA-rated, state-backed Swiss bank.

RULEMATCH uses the METACO system to facilitate the collateral management and settlement process.

In the METACO Harmonize system, 100% of the digital assets of each participant account are held off balance sheet with RULEMATCH on single, segregated blockchain addresses.

METACO Harmonize ensures that withdrawals from these blockchain addresses can only take place to whitelisted destination addresses. RULEMATCH offers a 4-eyes principal workflow for the whitelisting of new destination addresses. However, only authorized administrators of the respective participant account may request a new destination address.

As part of the approval workflow, RULEMATCH re-verifies the identity of the requestor of a new destination address using the Fidentity system. To protect the confidentiality and availability of blockchain private keys, METACO Harmonize is integrated with the FIPS 140-2 Level 4 certified HSM of IBM where the blockchain address keys are always held.